01 Aug Could we all use a scheduler?

Last fall, I started calculating the time it takes me to do my work including travel time, the courtesy pre-assignment time, the hours of waiting, the hours worked, the time for billing, e-mailing, confirmations, follow up, searching for work, etc. I realized that I was down to almost minimum wage, again. I say again, because I had done this calculation years before when I was quite satisfied with my salary working as an accounting manager, until I realized I worked too many hours for such an amount. So much effort and so little money compared to the number of hours invested. It was just not making sense, and I was disappointed.

A business owner must perform tasks most of us do not like or at least like less than what is directly related to language skills.

Some of these tasks, at least as I have been able to identify them, are the following:

1. Billing

2. Reconciling: bank accounts, payables, and receivables

3. Processing payables and receivables

4. Collections

5. Recording all transactions

6. E-mail follow up

7. Search for new work or new work orders/assignments

8. Promotional and marketing work

As T&I practitioners we never cease to educate stakeholders about the importance of hiring a professional; we, however, have not yet taken that important lesson home. There are many areas in which DIY is a good idea. Sometimes in an emergency I do my own manicure but obviously it does not last more than a couple of days, it does not have the quality I like, and it takes me a very long time to do what a pro would have done way better in half the time. Changing your car’s oil could probably save you a few dollars, but the job will take you three times as long, and you risk ruining that nice white shirt or leaving a permanent stain in your garage. The same can be said about dying your own hair or installing the floor in your kitchen. There are pros for everything.

As T&I practitioners we never cease to educate stakeholders about the importance of hiring a professional; we, however, have not yet taken that important lesson home. There are many areas in which DIY is a good idea. Sometimes in an emergency I do my own manicure but obviously it does not last more than a couple of days, it does not have the quality I like, and it takes me a very long time to do what a pro would have done way better in half the time. Changing your car’s oil could probably save you a few dollars, but the job will take you three times as long, and you risk ruining that nice white shirt or leaving a permanent stain in your garage. The same can be said about dying your own hair or installing the floor in your kitchen. There are pros for everything.

On the one hand, there are functions we must perform ourselves, such as the actual language-related work. That is non-negotiable. But there are areas in our business that we can delegate to others who do this specific kind of work daily and who can do it better and faster. More importantly, they can do it at a lower price than it costs us when we do it ourselves.

After my hourly versus income calculation, it dawned on me: I needed to outsource the administrative part of my business. Other than my banking, which I like to do myself, most of the tasks listed above can be done by a contractor just like me.

The U.S. Bureau of Labor Statistics shows that mid-level receptionists, schedulers, administrative assistants, and even secretaries earn a fraction of what I do, so it makes sense to hire a professional to do this important work for me.

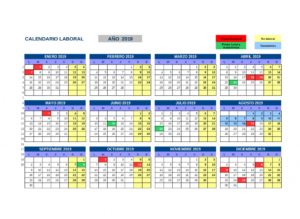

When I first started freelancing again, I wanted to buy QuickBooks for all my bookkeeping needs, but it did not feel like I had the volume to justify the expense, so I created an Excel worksheet where I recorded all my assignments. With time, that spreadsheet became my calendar. I included everything that I do: vacations, social events, classes, haircuts, doctor’s appointments; it all went in there. That prevented me from double booking my time.

So, when I started using the services of what began as a scheduler, and became a full-fledged administrative assistant, the transition was easy. All I had to do was to share a link of my schedule so that we both could work off the same document. It is my document, but my admin can do all the work there, and I continue to have access and control of it. It is a strange document because the amounts are also kept there as are the invoice numbers, my monthly and annual income, all with formulas and links, as well as all sorts of details about my social and personal life. But it has worked for me so far.

One of the advantages of having this kind of help is that what used to take me ten to fifteen hours a week is done now in five to ten, and all is done on time. My invoices are all now sent the minute I finish an assignment, sometimes before I even make it to my car. Work e-mails started to go straight to my assistant, and now I rarely answer e-mails myself. I still continue to nurture my relationships with my clients and colleagues, but I do not have to do the follow-up work. It also allows for better relationships because I do not have to call on my clients for late payments and thus, I am not the bad guy, although just recently I had to deal with a client that is in fact three months behind, but it is rare that I get involved in anything unpleasant.

One of the advantages of having this kind of help is that what used to take me ten to fifteen hours a week is done now in five to ten, and all is done on time. My invoices are all now sent the minute I finish an assignment, sometimes before I even make it to my car. Work e-mails started to go straight to my assistant, and now I rarely answer e-mails myself. I still continue to nurture my relationships with my clients and colleagues, but I do not have to do the follow-up work. It also allows for better relationships because I do not have to call on my clients for late payments and thus, I am not the bad guy, although just recently I had to deal with a client that is in fact three months behind, but it is rare that I get involved in anything unpleasant.

Some of the advantages of this system are the following:

-

-

- It allows me to block personal time before my schedule gets filled with work.

- I work less and earn more because my time is used in T&I assignments with that kind of earning potential.

- I no longer miss assignments because I am driving when an assignment becomes available and I am unable to e-mail or text back. Better yet, I do not have to pull over or get distracted looking at my phone while driving or at assignments. That is a great relief!

- I get to accept the assignments that pay more, take less time, and are closer to home, because the person that makes that decision has all the data at hand and their attention focused on making that decision.

-

I now have a four-day-per-week recurring contract, so I need only five invoices per month, and I don’t have to be chasing work, and yet I retain these services because they mean that I am now able to concentrate on what I like the most: the fun part of my business!

Another advantage of this is that since my admin bills me hourly, when I have less work, I pay less, and vice versa.

There are great platforms online to find independent contractors who will perform these tasks for you, or even to find work for yourself. You can also consider a family member or someone you know that works from home and does not have a high-pressure job. It can be a win-win situation.

This is a personal business decision, and only you know what’s best for you, but if you do the “minimum-wage test” and are getting close, consider this other option.

Hilda Zavala-Shymanik is a state certified/approved Spanish court interpreter and translator with more than fifteen years of experience in legal, medical, corporate, and non-profit settings in New York, New Jersey, Illinois, and Wisconsin. She is a board member, treasurer, Conference Committee chair, member of the Training and Education Committee and blog team of the National Association of Judiciary Interpreters and Translators as well as former president of the New York Circle of Translators. She is an active and voting member of NAJIT, ATA, and other professional groups. Hilda has two certificates in Legal Interpreting in Spanish and English, the latest one from NYU. Hilda is a former a Staff Interpreter at Essex County Superior Court in New Jersey, where she worked for six years. She now lives and works as a freelance interpreter in the Chicagoland area. Born in Chicago, Hilda lived for twenty years in Mexico and loves traveling. She continuously looks for opportunities to promote and advance the interpreting profession. Contact: hshymanik@yahoo.com

Hilda Zavala-Shymanik is a state certified/approved Spanish court interpreter and translator with more than fifteen years of experience in legal, medical, corporate, and non-profit settings in New York, New Jersey, Illinois, and Wisconsin. She is a board member, treasurer, Conference Committee chair, member of the Training and Education Committee and blog team of the National Association of Judiciary Interpreters and Translators as well as former president of the New York Circle of Translators. She is an active and voting member of NAJIT, ATA, and other professional groups. Hilda has two certificates in Legal Interpreting in Spanish and English, the latest one from NYU. Hilda is a former a Staff Interpreter at Essex County Superior Court in New Jersey, where she worked for six years. She now lives and works as a freelance interpreter in the Chicagoland area. Born in Chicago, Hilda lived for twenty years in Mexico and loves traveling. She continuously looks for opportunities to promote and advance the interpreting profession. Contact: hshymanik@yahoo.com

Main photo (cropped) taken from “Trabajar de Asistente Virtual” at VisitaVirtual.info, under the CC BY-SA 4.0 license. First body photo taken from “Calc: calendario laboral” by José Juan at Cosas que pasan, under the CC BY-NC-SA 3.0 ES license. Second body photo “Reloj Cid” by Óscar at flickr, under the CC BY-NC-SA 2.0 license.

Great advice, Hilda!

Thank you for reading me, Reme!

I, too, use Excel for keeping my records. I researched several other possibilities,

especially getting a “real accountant” to come in and do my billing, but I could

find nothing that would work, especially since the billing was so complicated

(different “formula” for many of the various places / types of work I do).

I think for large companies the software needed would be warranted, but not

for us “little people”. When I did have to break down my income for unemployment

(for independent contractors during the pandemic – and which I was successful

in obtaining), it came to about $20/hr. I don’t spend any time looking for new

clients, so that is something I save time on. On paper what we get may sound

pretty good, but the reality is something far different!

This is a worthwhile read for those who are self-employed, as well as employees who are considering changing employers. I chose to be a staff interpreter for all the reasons you mentioned in your piece–I loathe admin work (yet I still do quite a lot of it as a staffer, but it’s part of my paid time at least). I think it’s important for independent contractors and anyone seeking work as an employee to consider these hidden costs that bring down our actual hourly rate or wage. For example, I could work further away and make a higher salary, but the tolls, fuel, and increased vehicle maintenance costs mean is would cost me about $15,000 a year to work in the city, not to mention the extra 15 hours a week in commuting, which if paid for that time, would cost me thousands more. Then there’s also the opportunity cost: less time for health, fitness, cooking meals, time with family and pets, gardening,.. Therefore, in my case, commuting for even a 30% higher salary would be too “expensive”! You are right to advise folks to consider their true earnings after all of these other “costs” are accounted for.

Thank you Hilda for this encouraging and insightful piece. I always wondered if I was the only one who procrastinated on all administrative duties. Happy to read I am not. It is a sound and practical idea to hire an assistant. I have tried to do so and the training side has taken me a while. All I want to do is interpret!!! Anyhow, thank you. These short posts from NAJIT are another great way to support interpreters out in the field.

Yes, Hilda, this is great. A reality check for freelancers and employees alike. “Now and again/I get the feeling/If I don’t win/I’m gonna break even” — Tom Petty & The Heartbreakers sang that one.

Thanks!